Power Purchase Agreement (PPA) and Sleeved PPA

In the context of an energy transition towards so-called “green energy”, which implies efforts both on the part of the state, which dictates the energy policy and defines the regulatory framework for the development of the energy market, and the participants in it – from the producer to the end consumer of electricity, renewable energy is proving to be the most profitable long-term choice for corporate consumers. This is due to the fact that by choosing ‘clean energy’, consumers are on the one hand helping to protect the environment and on the other reaping the benefits of lower green energy prices.

The options for the supply of “green energy” by corporate consumers is either to sign a contract with a trader who buys energy from existing renewable energy facilities, whereby so-called guarantees of origin are generated, or to conclude a so-called long-term power purchase agreement with the producer of “clean” energy (for a period of 10, 15 or 20 years). In this type of contract, the consumer makes a long-term commitment to use and buy the energy produced by new renewable energy projects.

Legislative prerequisites for signing of PPAs in Bulgariа

The signing of such long-term power purchase agreements is possible due to the fact that as per Bulgarian legislation, power plants commissioned after 01.01.2019 are not obliged to sell their energy on/through the Bulgarian Independent Energy Exchange (IBEX), which was established in 2014 as part of the liberalization of the energy market. This makes the conclusion of such a direct transaction between the producer and the consumer possible. On the other hand, it should also be pointed out that consumers and traders in a contract for the purchase of renewable energy after 01.11.2.019 do not pay price obligations to society (Article 35a, paragraph 3 of the EA). Finally, power plants commissioned after 01.01.2021 are exempted from the 5% fee on the revenue balancing cost payable to the Power System Security Fund.

Power Purchase Agreement (PPA)

The power purchase agreement is a long-term delivery contract between electricity generator (the seller) and electricity purchaser (the buyer).

Depending on the specific circumstances, the PPA may be physical PPA or financial PPA (synthetic or virtual). The main difference is that under the physical PPA, the energy output is delivered to the buyer physically, while the financial (virtual) PPA includes an agreement between RE producer and electricity buyer about a hedging for a contractually defines amount of electricity or green certificates.

There are two types of physical PPAs depending on the possibility for a direct electrical wiring – direct PPAs and sleeved PPAs. Both direct and sleeved PPAs are varieties of the physical PPA. While the direct PPA requires the RE power plant to be close to the consuming facility (e.g., factory), due to the need of а direct wiring connection, the sleeved PPA does not imply such direct connection.

Sleeved PPA

The Sleeved PPA is the best solution in the event of a long distance between the RE power plant and the consuming facility, in which case there is no financial or organizational sense in building direct connection. The contracting parties do not have to be located even in the same grid area insofar as the green electricity is not delivered physically to the buyer, but the latter does obtain the contracted amount from the grid at the time it is fed-in by the RE producer.

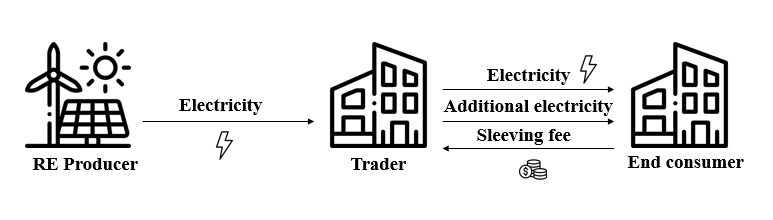

As per the Sleeved PPA structure, the buyer purchases the RE electricity from the RE producer by involving a balance responsible party (trader), which acts as an agent of the buyer and manages the offtake in consideration of a management fees called “sleeves “or “sleeved fees”. The trader carries out the adjustment of the generator’s production schedule to the consumer’s schedule (so-called sleeving). The trader shall supply 100% of the required electricity, which shall include the agreed between RE producer and the consumer.

The Sleeved PPA is designed as a three-way contract among RE producer, balance responsible party (electricity supplier/trader) and end-user/consumer. Therefore, the structure of the Sleeved PPA consists of relationships between:

- The RE producer and the electricity supplier;

- The electricity supplier and the end-user, who purchase the RE outputs;

- The RE producer and the end-user

As per the Bulgarian legislation, in case of a sleeved PPA, the end consumer will enter into two agreements:

- With the RE producer for supply of green energy;

- With the electricity supplier (trader) for the additional quantities of electricity required for his consumption

Therefore, the end consumer shall pay:

- Renewable energy price to RE producer

- Price for the additional quantities of electricity and a fee (sleeving fee) for balancing the quantities of energy.

Pros and Cons

The main benefits of the Sleeved PPA are as follows:

- The buyer does not need to be familiar with the wholesale power market dynamics;

- The buyer (end user) does not assume the market (price) risk and is not subject to the wholesale power marker price fluctuations;

- Reliability of power supply – power when the renewable project is not producing;

- Control over power-pricing relationship

- Long term, fixed rate for power

The only drawback of the Sleeved PPA is that the buyer must pay the utility a management fee (sleeving fee).

For more information about your PPA options and the best solutions to meet your energy needs, contact our team.

Back to news